nj ev tax credit 2020

With that law the state now offers 5000 rebates to eligible customers to purchase electric vehicles along with previous provisions giving tax credits to purchase zero-emission vehicles and. January 13 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car.

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

EV tax credit for new electric vehicles Current EV tax credits top out at 7500.

. New Jerseys Energy Master Plan outlines key strategies to reduce energy consumption and emissions from the transportation sector including encouraging electric vehicle adoption electrifying transportation systems leveraging technology to reduce emissions and miles traveled and prioritizing clean transportation options in underserved communities to reach the. Doug OMalley director of Environment New Jersey said there is still a huge demand and interest in electric vehicles and the rebate program despite the economy and he cautioned against dipping into the money for future budget woes. - No sales tax - 5000 NJ incentive - 500 NJ charger install incentive.

For those not familiar with New Jerseys EV program. New Jersey was offering money back but that program expired. NJ will provide 500 towards that and the federal 30 tax credit for installing one was just RETROACTIVELY extended to Dec 31 2020.

New Jersey Turnpike Authority Authority allows qualified plug-in electric vehicles to travel in the HOV lanes located between Interchange 11 and Interchange 14 on the New Jersey Turnpike. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles. Charge Up NJ EV Rebate NJ State Sales Tax 6625 Cost After Incentives.

Zero Emission Vehicles are exempt from the NJ state sales tax so youll save 6625 on the sale lease or rental of a new or used battery electric vehicle also known as all-electric vehicle. 5432B-855 The New Jersey Sales and Use Tax Act provides a sales and use tax exemption for zero emission vehicles ZEVs which are vehicles certified pursuant to the California Air Resources Board zero emission standards for the model. Electric Vehicles Solar and Energy Storage.

The amount of your NJEITC is a percentage of your federal Earned Income Tax Credit. New Jersey earned a high ranking after it passed a 2019 law with added incentives for using electric vehiles according to the Plug in America analysis. 2015 2016 2017 2018 2019 2020.

As in you may qualify for up to 7500 in federal tax credit for your electric vehicle. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. Up from 65627 in.

For 2021 the NJEITC amount is 40 of the federal credit amount. With the Fed EV tax rebate gone for 2020 this is the next best thing along with no sales tax for EV purchase. The credit ranges between 2500 and 7500 depending on the capacity of the battery.

For more information see the Authority Travel Tools website. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. Office of the Governor Governor Murphy Affirms Electric Vehicle Rebate Eligibility Effective as of January 17 2020 So if you are waiting to buy a Tesla.

But when combined with the federal tax credit of up to 7500 EV drivers in the Garden State can get as much as 12500 off. 0 0 You Save 4366 58400 Audi 2021 e-tron sportback. But adding in the 5000 incentive 7500 federal tax credit and zero New Jersey tax the price would drop into the 20000 range.

Here are the currently available eligible vehicles. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer.

Audi 2021 e-tron 222. EV 6 58 khw 774 khw 7500. This exemption does not apply to plug-in hybrid electric vehicles.

So install one this year get 500 from NJ and then 30 back from the feds. 2020 NJ Resident EV buyers gets 5000 in tax rebate and no sales tax. 2018 2019 2020 2021 2022.

Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. At first glance this credit may sound like a simple flat rate but that is unfortunately not the case. 2019 2020 2021 2022.

The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. In January 2020. Charge Up New Jersey.

Combined with the federal tax credit of up to 7500 EV drivers in the Garden State were getting as much as. Charge Up New Jersey. 4200 0 You Save 3010 33745 BMW 2019 i3.

The Charge Up New Jersey program is funded on an annual basis with 30 million from the Plug-In Electric Vehicle Incentive Fund which was established by the EV Act NJSA. Base models of. New Jersey just restarted its electric vehicle incentive program.

So that 50k Model Y purchase gives you 5000 in. Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. The EV Act codified the goal of 330000 registered light-duty electric vehicles in the state by 2025 putting New Jersey.

The federal maximum amounts are available on the IRS website. Zero Emission Vehicle ZEV Tax Exemption. New Jersey already waives the 7 sales tax on electric vehicle purchases and the federal government offers a 2500 to 7500 income tax credit based on a cars battery capacity.

Beginning on January 1 2021. Its a GREAT year to buy an EV in the Garden State. On January 17 2020 Governor Murphy signed S-2252 into law PL2019 c362 which created an incentive program for light-duty electric vehicles and at-home electric charging infrastructure.

1 - Theres now a 5000 rebate for EVs with an MSRP under 55000. 0 You Save 3776 49500. Local and Utility Incentives.

BMW 2020 i3 REX 168-223. Sales Tax Exemption - Zero Emission Vehicle ZEV Sales Tax Exemption - Zero Emission Vehicle ZEV NJSA. 2017 2018 2019 2020.

4825-1 et seq and signed by Governor Murphy on January 17 2020.

Latest On Tesla Ev Tax Credit February 2022

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Latest On Tesla Ev Tax Credit February 2022

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Electric Car Tax Credits What S Available Energysage

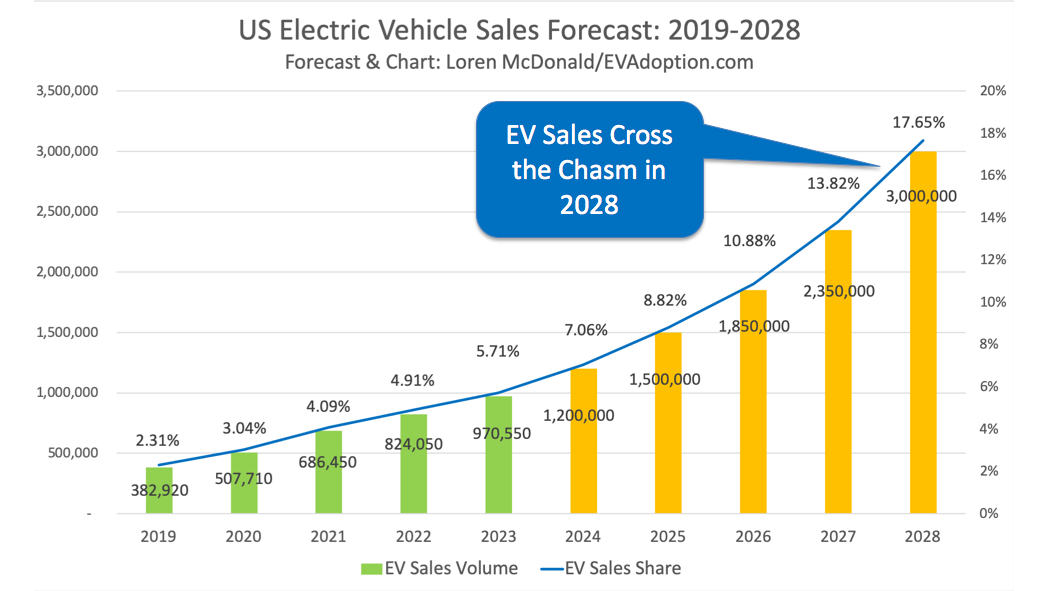

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

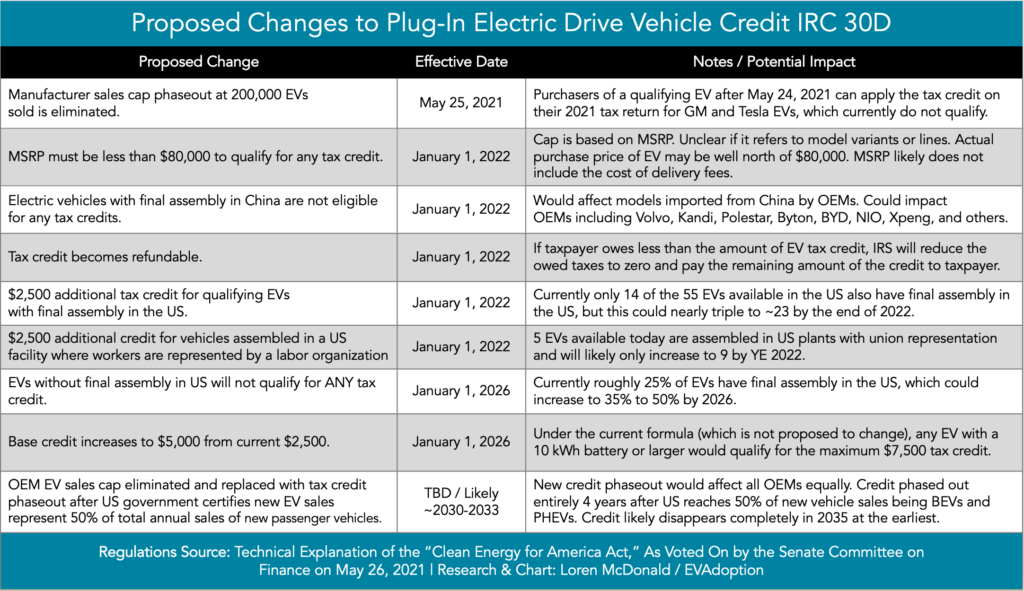

Legislation Regulations Evadoption

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption